A week has passed since the White House reintroduced a 25% tariff on aluminum and steel on all global imports.

The move to reimpose tariffs, first implemented in 2018, comes as the current administration says it’s aiming to protect America’s aluminum and steel industries from “unfair trade practices and global excess capacity.”

While several industry and union figures, including Aluminum Association president Charles Johnson and American Primary Aluminum Association president Mark Duffy, applaud the moves, most organizations are wary that the tariffs, should they take effect as scheduled on March 12, will harm United States companies and consumers. In particular, the construction industry faces a complex landscape in the coming years, especially smaller firms running on tight margins.

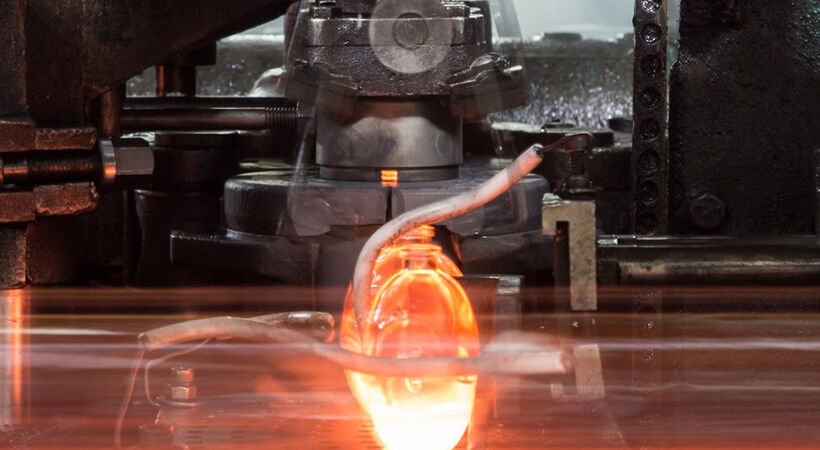

The Council on Foreign Relations says the tariffs will likely raise costs for industries that rely on aluminum and steel, such as the glass industry, which uses aluminum for window, door, storefront and curtainwall systems. According to the U.S. Department of Commerce, America obtains nearly half (44%) of its aluminum abroad. Two-thirds come from Canada. A 25% tariff on aluminum will increase prices throughout the built environment, trickling down to consumers.

The National Association of Home Builders (NAHB) argues the new tariffs are projected to raise the cost of imported steel and aluminum products by several billion dollars, adding layered costs that could impact builders’ ability to deliver new single-family and multifamily projects.

“Through an executive order on his first day in office, President [Donald] Trump made it a top priority to reduce housing costs and increase housing supply to ease the nation’s housing affordability crisis,” says NAHB chairperson Carl Harris. “The administration’s move to impose 25% tariffs on all steel and aluminum products imports into the U.S. runs totally counter to this goal by raising home building costs, deterring new development and frustrating efforts to rebuild in the wake of natural disasters. Ultimately, consumers will pay for these tariffs through higher home prices.”

The glass industry also expects the tariffs to increase costs throughout the sector. An informal poll conducted by USGlass magazine found that 65% of respondents expect increased costs due to the tariffs. Fourteen percent of respondents expect to see some increases, and 14% expect no significant changes. Six percent of respondents stated they don’t use aluminum.

Not all news is negative, however. S&P Global research indicates minimal impact on consumer prices and gross domestic product due to the tariffs. Its research notes that the tariffs should be positive for domestic aluminum and steel industries, though risks to downstream users are high.

According to S&P’s report, “Higher prices for imported products could ease competitive pressure that the U.S. producers are under. It could also lead U.S. producers to raise their prices—citing the new tariffs as the reason. That means U.S. producers that rely heavily on steel and aluminum imports would likely see their cost of doing business rise.”

The tariffs could be dialed back, much like in 2018, when Trump granted exemptions to Canada and Mexico, and President Joe Biden expended exemptions with the European Union, Japan and the United Kingdom. The Center for Strategic and International Studies notes that the tariffs are likely more in response to China’s state-driven overproduction of metals than a weapon to gain concessions from global allies. However, Bloomberg Intelligence reports China will barely feel the effect of the tariffs. The country’s largest aluminum manufacturer exports less than 1% of its product; others earn even less revenue from North America.

Source: The Council on Foreign Relations with additional information added by GlassBalkan