This past Wednesday, the Federal Reserve opted to maintain interest rates within the 4.25%-4.5% range, signaling a cautious approach amidst a complex economic landscape.

While acknowledging a robust economic activity and positive labor market conditions, the Fed’s decision reflects a growing concern over heightened uncertainty stemming from global economic headwinds and the impact of tariffs.

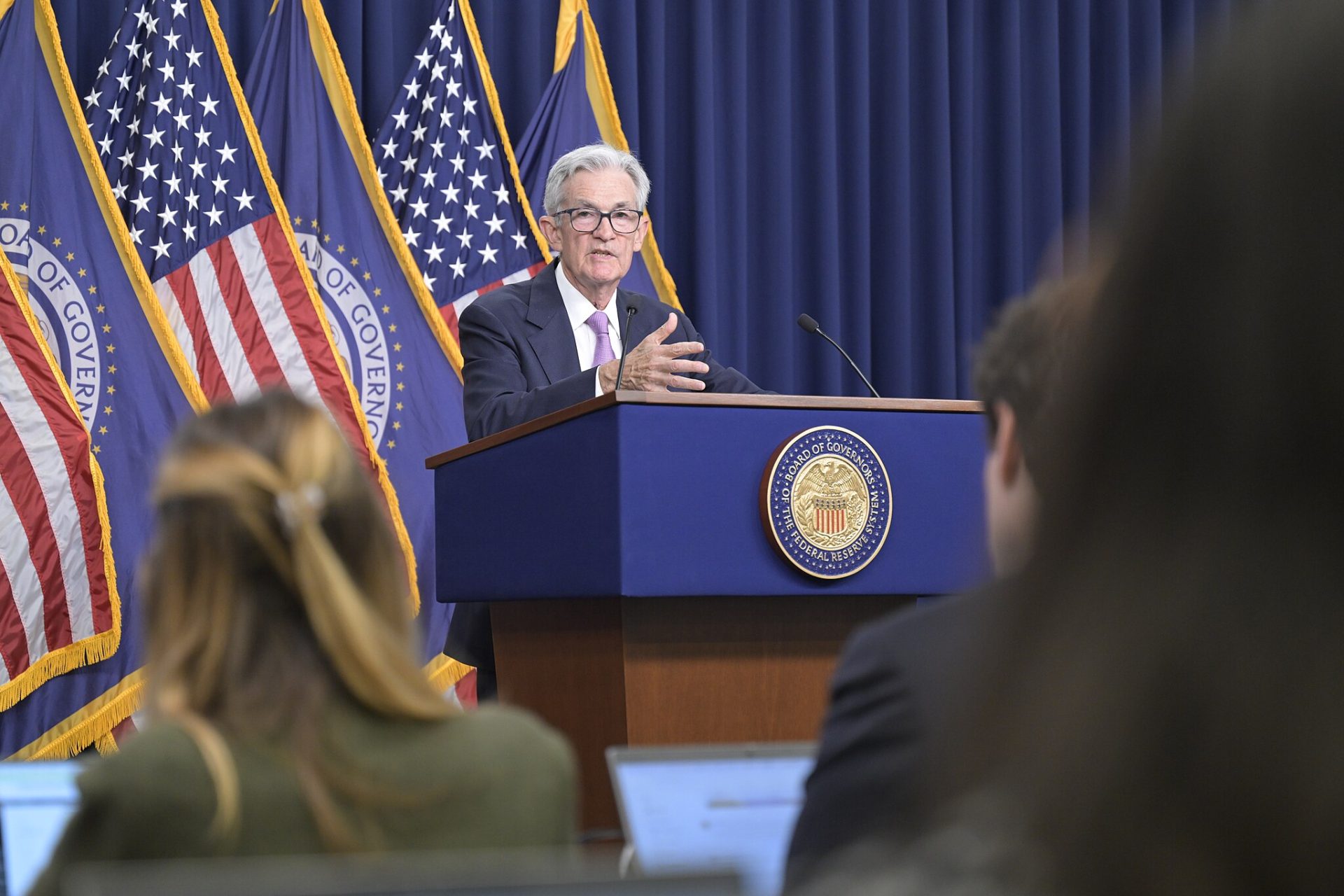

Chairman Jerome Powell, during last week’s press conference, emphasized the need for “greater clarity” before considering further adjustments. This cautious stance is largely driven by the difficulty in gauging the long-term effects of evolving economic policies and, notably, the ongoing trade disputes. The Fed’s primary objective remains focused on achieving stable employment and bringing inflation back towards its target of 2%.

Powell specifically highlighted the impact of shifting policies and tariffs, pointing to their historical tendency to hinder economic growth and exacerbate inflationary pressures. Recent Consumer Price Index (CPI) data from the Bureau of Labor Statistics reveal a continued upward trend in inflation, with a 0.2% increase in February following a more significant 0.4% rise in January. This raises concerns about the potential for a sustained inflationary environment, particularly given the Fed’s target rate.

The Fed’s statement also alluded to a potential slowdown in consumer spending, a key driver of economic growth. Surveys of households and businesses indicate a growing unease about the economic outlook, raising questions about the future trajectory of spending and investment. This deceleration, coupled with the inflationary pressures and policy uncertainty, presents a significant challenge for policymakers.

The ramifications of these uncertainties are already being felt within the financial community. The White House’s imposition of tariffs, including those on imported aluminum and steel, goods from China, and certain products from Canada and Mexico, has prompted financial institutions to reassess their economic forecasts. JPMorgan Chase has increased its recession odds to 40% from 30%, while Goldman Sachs has raised its 12-month recession probability to 20% from 15%, as reported by The Wall Street Journal.

Powell himself acknowledged the inflationary impact of tariffs, noting that they are contributing to the recent upward movement in inflation and potentially delaying progress in achieving the 2% target. Officials now estimate annual inflation to reach 2.7% by year-end, a slight increase from the previous forecast of 2.5%.

The Fed’s decision to hold steady reflects a desire to gather more data and assess the full impact of the evolving economic landscape. While some may view this as a prudent approach, others might argue that proactive measures are necessary to mitigate the risks associated with rising inflation and economic uncertainty. The coming months will be crucial in determining whether the Fed’s wait-and-see approach proves to be the right course of action, or whether more decisive intervention will be required to steer the economy towards its desired path of stable growth and controlled inflation. The market will be closely watching future CPI data and Fed pronouncements for further clues about the future direction of monetary policy.

Source: USGlass with additional information added by GlassBalkan