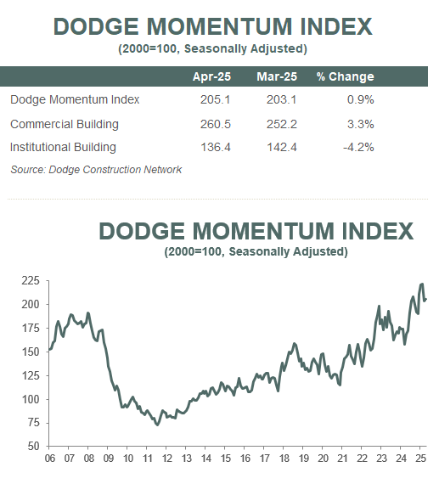

The latest data from the Dodge Construction Network (DCN) reveals a nuanced picture of nonresidential building planning activity in April. While the overall Dodge Momentum Index (DMI), a key indicator of future construction spending, registered a modest 0.9% increase over the month, a closer examination reveals divergent trends within the commercial and institutional sectors.

According to the newly released DMI data, commercial planning saw a 3.3% rise in April. However, this growth was significantly skewed by a surge in data center planning. Conversely, institutional planning experienced a decline of 4.2% during the same period.

As Sarah Martin, DCN’s associate director of forecasting, notes, “Despite an uptick in April, the bulk of the DMI’s growth was driven by a surge in data center planning, while momentum in other nonresidential sectors lagged.” This highlights the significant influence of a specific project type on the overall commercial planning figures. Martin further elaborates, “Owners and developers are navigating heightened economic and policy uncertainty, which likely bogged down much of this month’s planning activity.” This sentiment suggests that broader market anxieties are impacting decision-making across various nonresidential sectors.

Indeed, DCN officials emphasize the extent of the data center impact, stating that without these projects, commercial planning would have actually decreased by 2.3% in April, resulting in a 3% contraction of the overall DMI. Further illustrating this point, office and hotel planning both experienced declines in April, while warehouse and retail planning saw increases, indicating a mixed landscape within the commercial sector.

On the institutional side, the decline was more widespread. Planning momentum waned for education, healthcare, and government buildings. This downturn was only partially offset by a slight increase in recreational projects, suggesting broader headwinds impacting institutional development.

Despite the mixed monthly picture, the DMI demonstrates significant growth when viewed year-over-year. In April, the DMI was up a robust 22% compared to the same month last year. Both segments contributed to this substantial annual increase, with the commercial segment rising 20% from April 2023 levels and the institutional segment showing even stronger growth at 26%.

April saw the entry of 40 projects valued at $100 million or more into the planning stage. Highlighting the dominance of data centers in commercial planning, the most significant commercial projects included the TA Realty LLC Data Center campus in Dulles, Virginia, encompassing five data centers each valued at $384 million. Also notable were the $350 million QTS Data Center DFW2-DC3 in Lancaster, Texas, and the Powhatan Data Center Campus in Powhatan, Virginia, comprising three data centers each valued at $300 million.

Among the largest institutional projects entering planning were the $493 million Revere High School in Revere, Massachusetts, the $230 million Kaiser Permanente Sunnyside Medical Center Hospital Tower in Clackamas, Oregon, and the $203 million Kailua-Kona Hospital in Kaiminani, Hawaii. These projects demonstrate continued, albeit more limited, large-scale planning activity in the institutional sector.

In conclusion, the April DMI data underscores the current reliance on the burgeoning data center market to fuel commercial planning growth. While the overall index showed a slight positive movement, driven largely by this specific sector, underlying uncertainties and sector-specific declines in other areas of both commercial and institutional planning warrant careful observation. The DMI’s year-over-year strength provides a longer-term perspective, but the monthly fluctuations and the significant influence of data center development point to a potentially uneven path for nonresidential construction in the months ahead.

Source: USGlass with additional information added by GlassBalkan