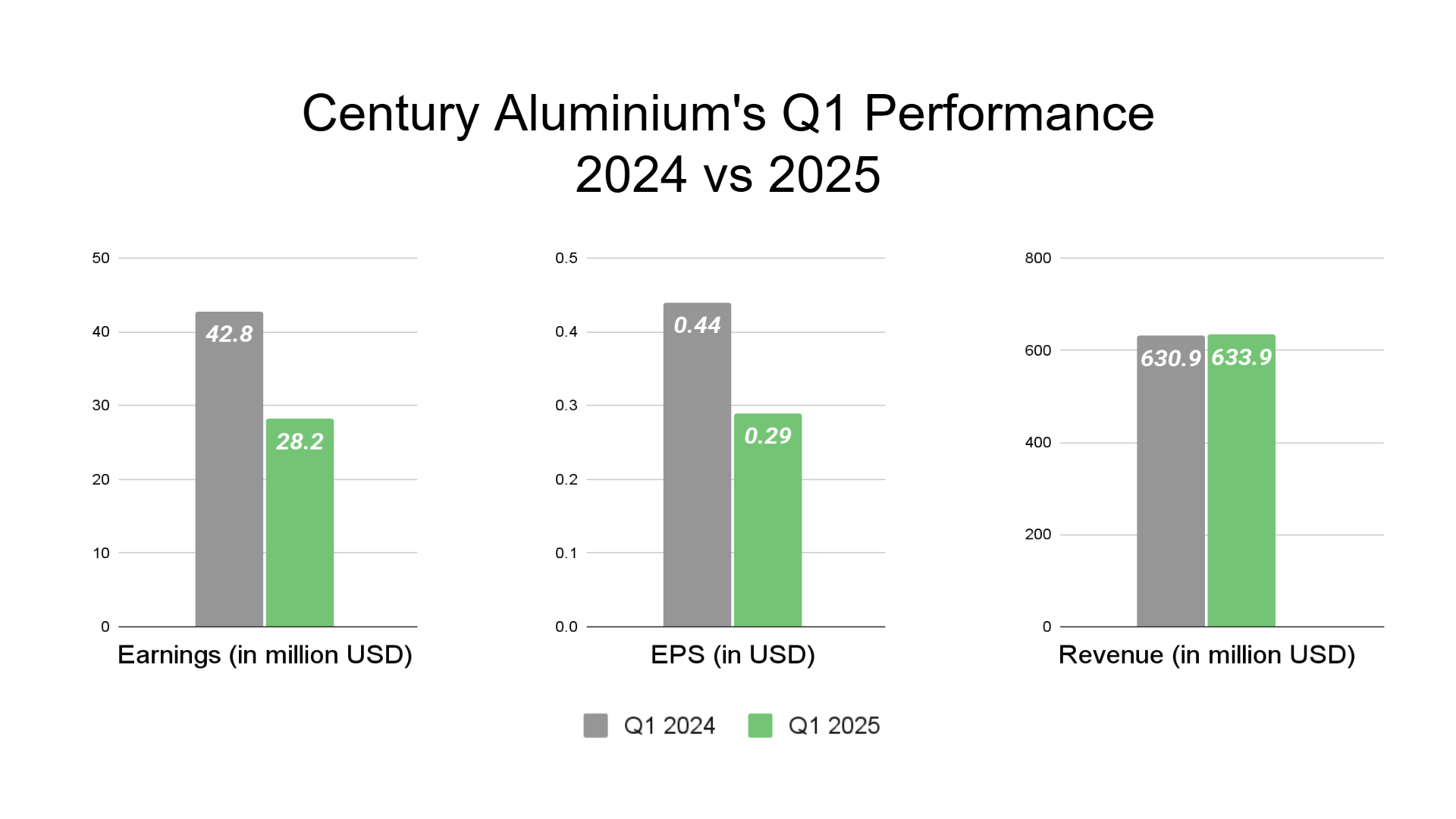

Century Aluminum Company (NASDAQ: CENX), a significant player in the aluminium industry with a market capitalization of USD 1.47 billion, recently released its first-quarter 2025 financial results. The report presented a nuanced picture, showcasing strength in revenue alongside a notable miss in expected earnings, leading to a negative market reaction.

The company reported earnings per share (EPS) of USD 0.29, significantly below the prior year’s USD 0.44 and analyst expectations. The adjusted EPS, which often provides a clearer view of core operational performance, also fell short, coming in at USD 0.36 against a projected USD 0.61. Despite the earnings shortfall, Century Aluminum demonstrated robust revenue performance, reporting USD 634 million, comfortably exceeding the anticipated USD 577.2 million and representing a marginal 0.48% increase year-over-year from Q1 2024.

Following the earnings release, Century Aluminum’s stock experienced a decline of 5.18% in after-hours trading, closing at USD 15. The stock’s beta of 2.7 highlights its inherent higher volatility compared to the broader market. This post-earnings movement positions the stock closer to its 52-week low of USD 11.40, indicating a divergence from prevailing market trends.

Despite the earnings miss, Century Aluminum’s Q1 2025 business highlights included several positive developments. The company reported a 1% increase in shipped tonnage compared to the previous quarter, reaching 168,672 tonnes. Net sales saw a modest quarter-on-quarter increase to USD 633.9 million. A notable positive was the realized Midwest premium, which surged by 38% from the preceding quarter to USD 602, reflecting favorable market conditions. The increase in Section 232 aluminum tariffs to 25%, coupled with the elimination of country exemptions, also provided a favorable impact of USD 16.2 million. The company achieved adjusted EBITDA attributable to Century stockholders of USD 78.0 million. Furthermore, Century Aluminum secured key operational stability through the ratification of a new five-year labor contract for its Grundartangi smelter and the extension of its power purchase agreement with Iceland’s largest energy provider through Q1 2032. As of March 31, 2025, the company reported a healthy liquidity position of USD 339.1 million, including USD 44.9 million in cash and cash equivalents.

Analyzing the financial details reveals the drivers behind the sequential shifts. The USD 3.0 million sequential rise in net sales was primarily attributed to a higher LME aluminum price, stronger regional premiums, and favorable volume and product mix, although this was partially offset by a reduction in third-party alumina sales. The sequential decline in net income, down USD 15.5 million to USD 29.7 million, was predominantly driven by elevated input costs and losses on derivative instruments. These headwinds were somewhat mitigated by improved metal and regional premium pricing. The quarter’s results were further impacted by USD 8.4 million in net exceptional items, including emergency energy charges at the Mt. Holly smelter and unrealized losses on derivative instruments. Consequently, adjusted net income for Q1 2025 stood at USD 36.6 million, a sequential decrease of USD 6.9 million. Adjusted EBITDA also saw a modest decrease of USD 2.9 million sequentially to USD 78 million, largely due to higher energy and raw material costs, despite the positive impact of enhanced metal and regional premium pricing.

Looking ahead to the second quarter of 2025, CEO Jesse Geary expressed optimism regarding future aluminum price trends. CFO Peter Trzipkowski reiterated the company’s strategic resilience. Century Aluminum anticipates adjusted EBITDA for Q2 2025 to be in the range of USD 80 to USD 90 million. This outlook is supported by expectations of an increased Midwest regional premium and lower energy costs, which are expected to partially offset planned major maintenance activities and seasonal labor-related expenditures.

Century Aluminum’s Q1 2025 performance presented a mixed picture. While the company successfully navigated a challenging input cost environment to deliver stronger-than-expected revenue, the impact of these costs and derivative losses significantly impacted earnings per share. The market’s reaction reflects concerns regarding the earnings miss. However, the company’s positive business highlights, robust liquidity, and forward-looking statements provide a basis for continued monitoring of their performance in the coming quarters as they aim to capitalize on favorable market dynamics and manage operational costs effectively.

Source: Century Aluminum Company with additional information added by GlassBalkan