The Chinese secondary aluminium market has recently experienced a period of significant volatility and downward pressure, driven by a confluence of macro-economic factors, shifting costs, and subdued demand. This post offers a detailed analysis of the key trends observed in April and early May, shedding light on the challenges and potential outlook for the sector.

The initial impact of the US reciprocal tariff served as a significant catalyst, triggering a sharp decline in the most-traded SHFE aluminium contract from levels exceeding RMB 20,000 per tonne in early April. While the contract subsequently stabilized within the RMB 19,000-20,000 range, the downstream effects were palpable. The SMM average spot aluminium price in April registered a notable decrease of 3.8% month-on-month (M-o-M), settling at RMB 19,952 per tonne. This downward trajectory extended to the price of ADC12, a key secondary aluminium alloy, which saw its average price in April fall by 2.5% M-o-M. By May 9th, the SMM ADC12 quote had further retreated by RMB 700 per tonne M-o-M, reaching RMB 20,200-20,400 per tonne.

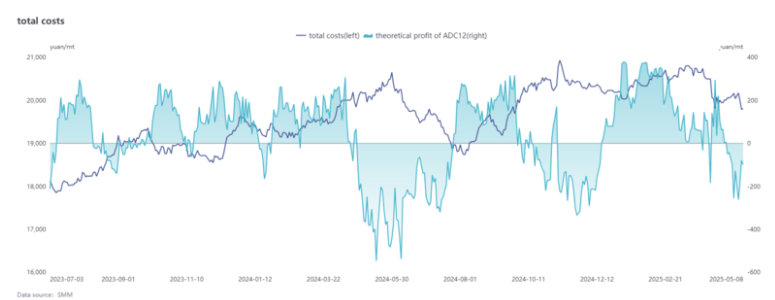

Examining the cost side reveals a dynamic interplay of factors. The early part of April saw a dip in raw material prices, including aluminium scrap, copper, and silicon, influenced by a broader correction in bulk commodities. This provided a temporary boost to the theoretical profitability of the ADC12 industry. However, this respite was short-lived. As trade tensions eased later in the month, a rebound in aluminium scrap and copper prices led to an overall increase in raw material costs. Despite a continued decline in silicon prices, the inability of finished alloy ingot prices to rise commensurate with input costs resulted in a contraction of profit margins, pushing some enterprises into a loss-making position.

The demand side presents a significant challenge. Contrary to seasonal expectations, the traditional “Golden March, Silver April” peak seasons failed to materialize as anticipated. Consumer demand remained weak, leading to a weakening in orders from downstream buyers. End-users have adopted a cautious “just-in-time” purchasing approach, exacerbated by the recent fluctuations in aluminium prices which have amplified a “wait-and-see” market sentiment. Compounding these domestic factors, the US tariff policy has directly impacted export orders for die-casting enterprises, with some reporting a substantial decline of 50% or even greater. This sustained pressure on demand has been a primary driver behind the significant price drop for ADC12 in April.

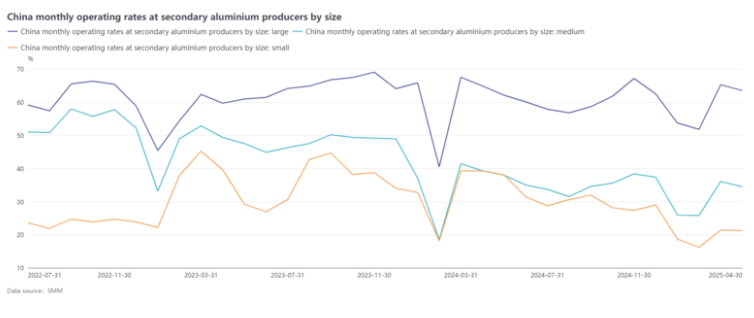

In terms of supply, the secondary aluminium alloy industry’s operating rate saw a slight M-o-M decline of 1.58 percentage points in April, settling at 53.49%. This also represented a 3.52% year-on-year decrease. The contraction in both domestic and overseas demand for secondary aluminium downstream products directly translated to reduced orders for secondary aluminium plants. Intense low-price competition further exacerbated the situation, as finished product prices fell more sharply than raw material costs, squeezing profit margins and forcing some enterprises to implement production cuts due to losses. The consistent pressure from weak demand and rising costs led to a week-on-week decline in the operating rate of secondary aluminium plants throughout April. These production cuts have helped alleviate inventory pressure, resulting in an overall contraction in industry supply. Looking ahead to May, a tightening in the supply of raw materials, particularly aluminium scrap, is anticipated. Combined with the increasingly prominent effect of the traditional off-season, the operating rate of the secondary aluminium industry is expected to continue its downward trend.

Entering May, the tightening circulation of aluminium scrap has lent notable price resilience to this key raw material, providing stronger cost-side support for ADC12 prices. However, a substantial recovery in demand remains elusive, constrained by the approaching traditional off-season and the ongoing pressure from tariff policies. This lack of demand-side momentum is expected to limit the upside potential for ADC12 prices. The pattern of low operating rates on the supply side is likely to persist, and macro-level trade policy risks continue to cast a shadow.

The Chinese secondary aluminium market currently faces a challenging landscape characterized by weak demand, squeezed profit margins, and supply adjustments. The near-term outlook suggests that secondary aluminium alloy prices will likely remain subdued. Market participants should closely monitor fluctuations in raw material prices, shifts in end-use consumption patterns, and the evolving transmission effect of tariff policies on export orders to navigate these turbulent conditions effectively.

Source: SMM with additional information added by GlassBalkan