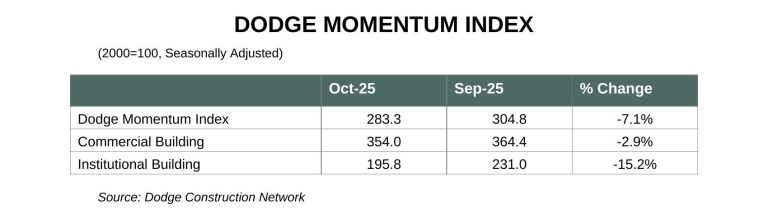

The Dodge Momentum Index (DMI) fell 7.1% in October, dropping to 283.3 from a revised 304.8, signaling a slowdown in planning for nonresidential construction projects. The index, published by Dodge Construction Network (DCN), tracks the three-month moving value of projects entering planning and is considered a leading indicator for construction spending over the next 12 to 18 months.

Commercial planning decreased 2.9% in October, while institutional planning saw a sharper decline of 15.2%. Despite this monthly pullback, year-to-date figures remain strong, with the DMI up 35% compared to the same period in 2024.

Sarah Martin, DCN’s associate director of forecasting, noted that although planning momentum eased, overall activity continues to be solid, particularly for data centers and hospitals. She emphasized that rising labor and material costs are contributing to higher project valuations, which partly explains the strong year-to-date numbers. DCN expects a continued deceleration in planning activity in the coming months amid ongoing macroeconomic uncertainties.

Notable large-scale projects entering planning in October included forty-five developments valued at $100 million or more. Key commercial projects featured Amazon’s Data Center Campus in Hamlet, North Carolina, with three $500 million buildings, the $500 million CyrusOne Data Center in Illinois, and the $500 million Hut 8 Corp. Data Center, also in Illinois.

Significant institutional projects included the $400 million Scripps Memorial La Jolla Medical Tower III in San Diego, the $260 million SW Life Science Park in Philadelphia, and the $198 million Mission Hospital Expansion in Asheville, North Carolina.

Source: construction.com with additional information added by Glass Balkan